38 advantage of zero coupon bond

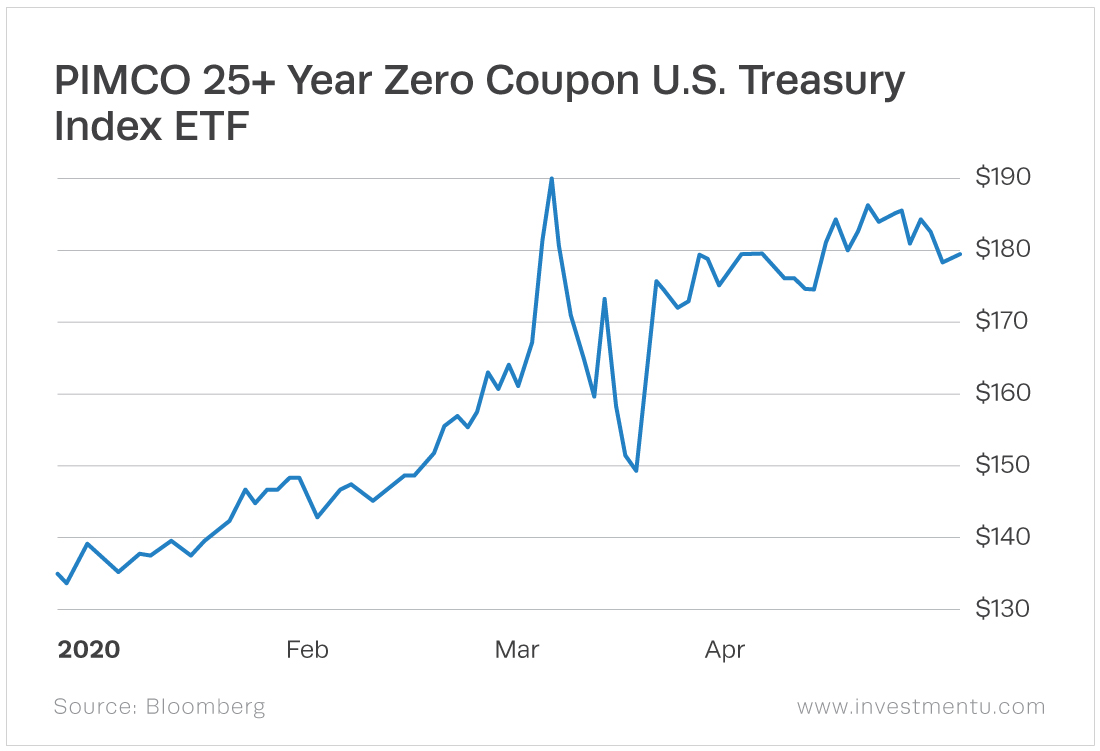

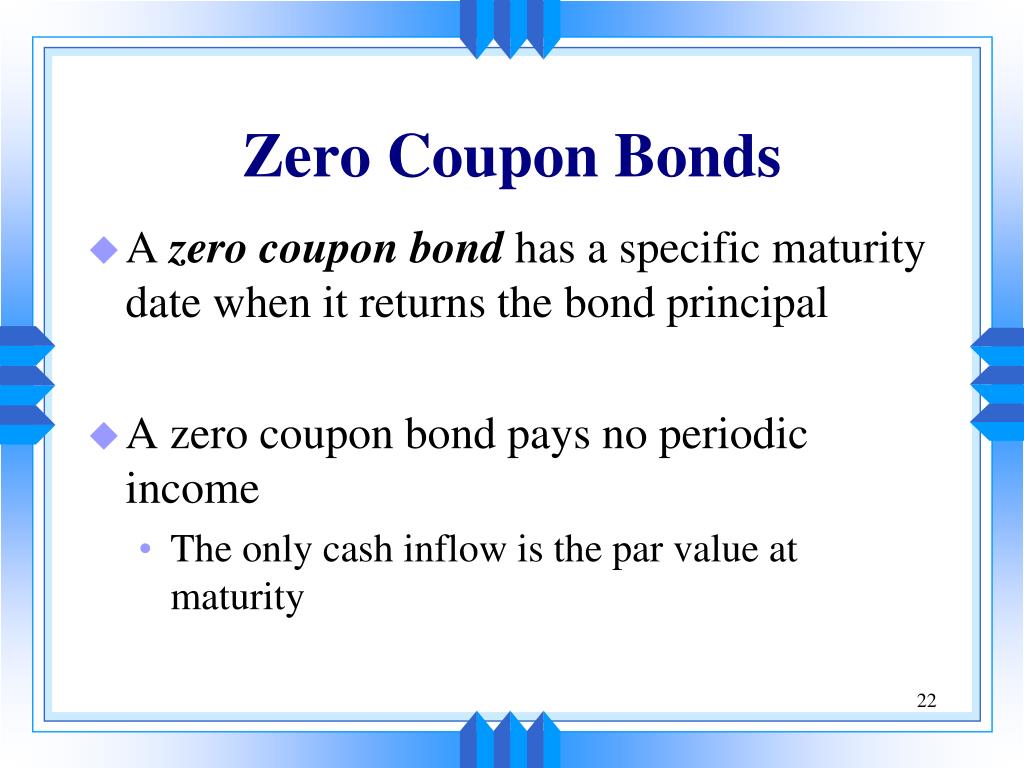

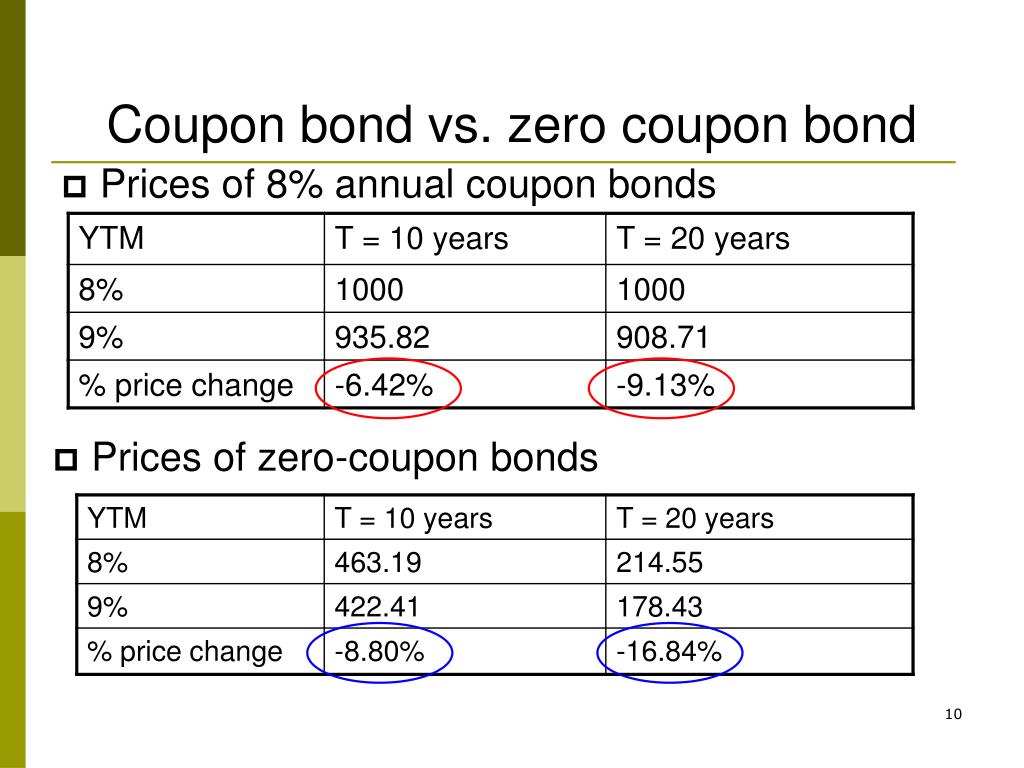

Corporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market.

Compare Fixed Rate Bonds | MoneySuperMarket Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable).

Advantage of zero coupon bond

What Is the Face Value of a Bond? - SmartAsset 15.1.2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Jan 15, 2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Advantage of zero coupon bond. Convertible Bond Definition - Investopedia 6.10.2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Theorem 4.9 (Option on a zero-coupon bond in the Vasicek model). In the Vasicek model, the price of a European call option with strike K and maturity T and written on a zero-coupon bond with maturity S at time t ∈ [0,T] is given by ZBC(t,T,S,K)=P(t,S)Φ(h)−KP(t,T)Φ(h−σ˜), where σ˜ = σ 1−e−2k(T−t) 2k B(T,S) and h = 1 σ˜ ln P ... CHAPTER 4 One-Factor Short-Rate Models 4.1. Vasicek Model Definition 4.1 (Short-rate dynamics in the Vasicek model). In the Vasicek model, the short rate is assumed to satisfy the stochastic differential equation dr(t)=k(θ −r(t))dt+σdW(t), where k,θ,σ >0andW is a Brownian motion under the risk-neutral measure. Theorem 4.2 (Short rate in the Vasicek model). en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Zero-coupon bond; Commercial paper; Bonds by issuer. Corporate bond; ... The primary advantage is that the instrument helps in the price discovery process. In the ...

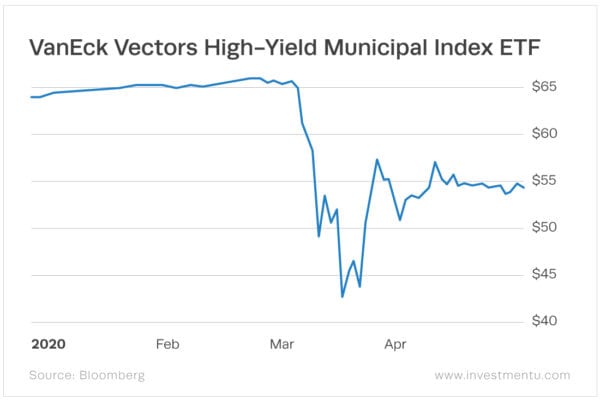

Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Bond Investor - Raymond James 1 päivä sitten · Municipal Bond Investor Weekly High Net Worth Wealth Solutions and Market Strategies // Fixed Income Solutions TED RUDDOCK Managing Director Fixed Income Private Wealth THE WEEK AHEAD 1. Municipal yields are higher across the curve by 6-12 basis points with tax-exempt yields from 2.23% to 3.24% 2. Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Zero coupon bonds are bonds that do not make any interest payments until maturity, you won't put a single penny of interest in your pocket for two decades. investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate.

Duration: Understanding the Relationship Between Bond … That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · However, that significant advantage also comes with several unique risks. KEY TAKEAWAYS. ... If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used ... Yield to Maturity (YTM) Definition & Example | InvestingAnswers 10.3.2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate. › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Jan 15, 2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

What Is the Face Value of a Bond? - SmartAsset 15.1.2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

Post a Comment for "38 advantage of zero coupon bond"