40 what does coupon rate mean

Bond prices, rates, and yields - Fidelity Investments While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ... Coupon Definition | Bankrate.com A coupon in the financial world is defined as the annual interest rate paid on a bond that is expressed as a percentage of its face value. This also can be referred to as a bond's coupon rate,...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

What does coupon rate mean

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... investing - What do the terms par value, purchase price, call price ... From an accounting standpoint, the coupon rate lowers the amount of real monies paid; the same $1m in bonds, maturing in 10 years with a 5% expected rate of return, but with a 5% coupon rate, now only requires payments totalling $1.5m, and that half-million in interest is paid $50k at a time annually (or $25k semi-annually). Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement

What does coupon rate mean. What is a Current Coupon? (with picture) - wiseGEEK Last Modified Date: June 01, 2022. 'Coupon' is the interest payment on a loan, and 'current' refers to an instrument that is at the going market rate. The current coupon is a term used to describe a certain to be announced mortgage backed security with a current delivery month. The security that is trading closest to its par value without going ... Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate " refers to the rate of interest paid to the bondholders by the bond issuers. In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon Rate vs. Yield. While coupon rate is the percentage that a bond returns based on its initial face value, yield refers to a bond's return based on its secondary market sale price. It is what the bond is worth to its current holder. When the current holder is the initial purchaser of the bond, coupon rate and yield rate are the same.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? Difference Between Yield & Coupon Rate | Difference Between 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value. 3.Yield rate and coupon rate are directly correlated. The higher the rate of coupon bonds, the higher ... Yield To Worst: What It Is And Why It's Important - IQ Calculators What does "called" mean? ... The coupon rate is 6% meaning it pays $60 in coupon payments annually. The bond is callable in 2 years but John plans to hold the bond until maturity which is in 10 years. By using a yield to maturity calculator "THAT IS A BIG RISK IF THE BOND WERE TO BE CALLED!" Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the...

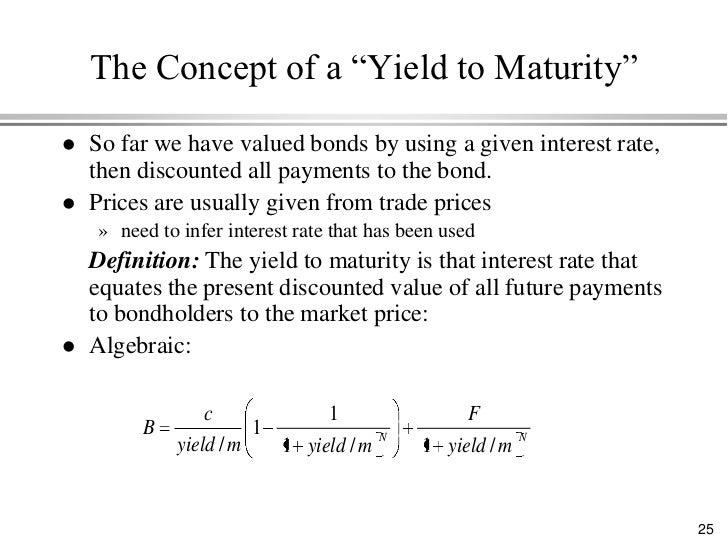

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

What does Coupon Rate mean? - YouTube The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a brief explanati...

What Are Coupon and Current Bond Yield All About? - dummies What current yield means to your investment. Current yield is derived by taking the bond's coupon yield and dividing it by the bond's price. Suppose you had a $1,000 face value bond with a coupon rate of 5 percent, which would equate to $50 a year in your pocket. If the bond sells today for 98 (meaning that it is selling at a discount for ...

The Difference Between Coupon and Yield to Maturity - The Balance To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount that's a percentage of the original bond price. Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Difference Between Coupon Rate and Interest Rate Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders. What Does Coupon Payment Mean? What is the definition of coupon payment?

Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement

investing - What do the terms par value, purchase price, call price ... From an accounting standpoint, the coupon rate lowers the amount of real monies paid; the same $1m in bonds, maturing in 10 years with a 5% expected rate of return, but with a 5% coupon rate, now only requires payments totalling $1.5m, and that half-million in interest is paid $50k at a time annually (or $25k semi-annually).

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Post a Comment for "40 what does coupon rate mean"