38 yield to maturity of a zero coupon bond

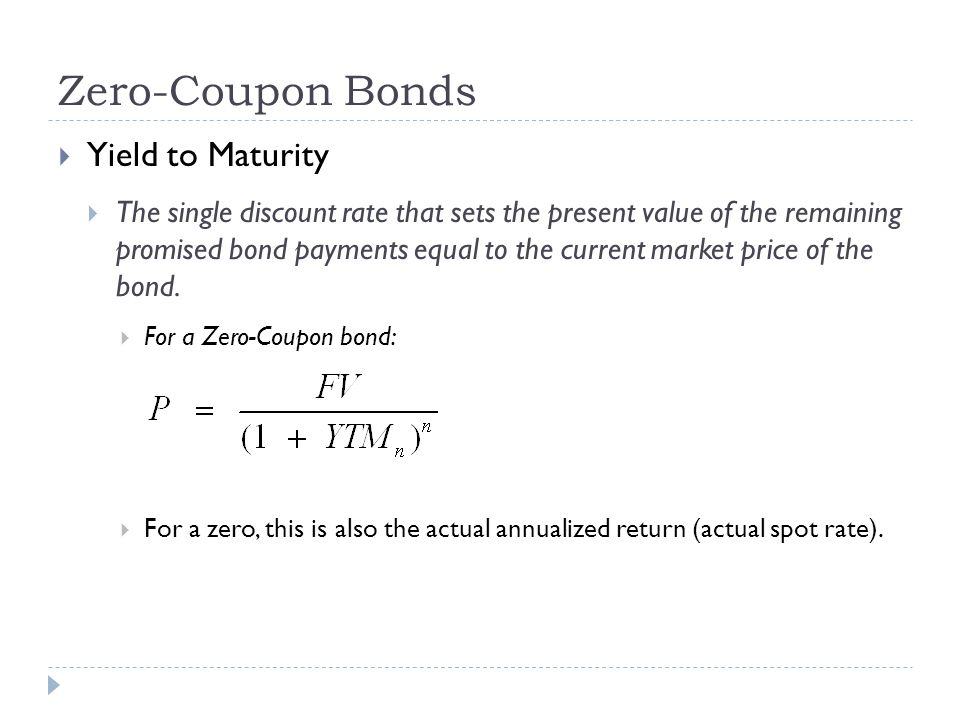

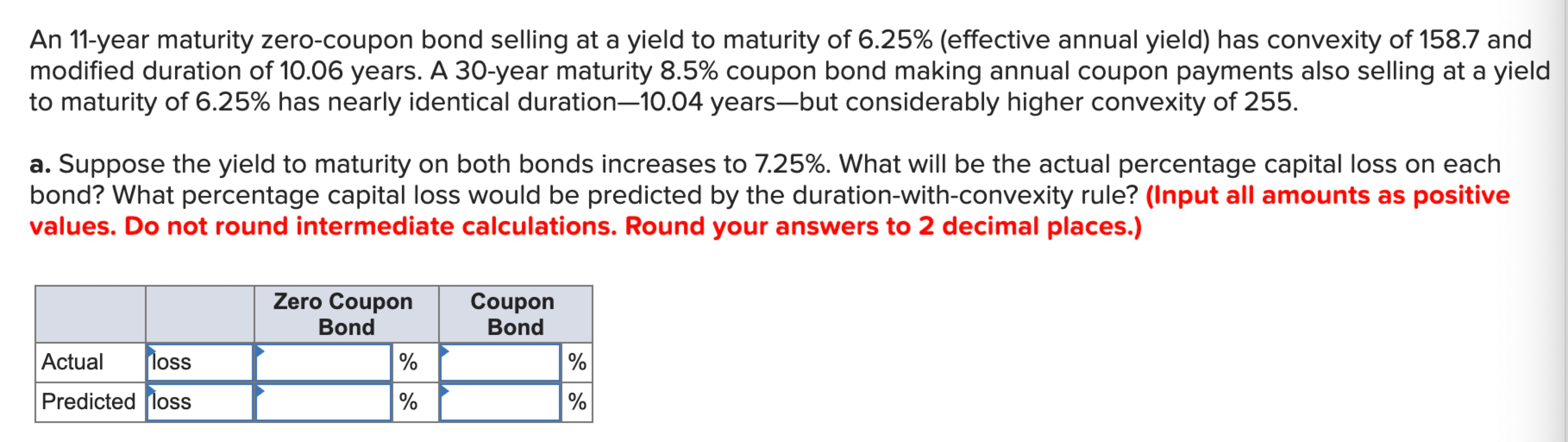

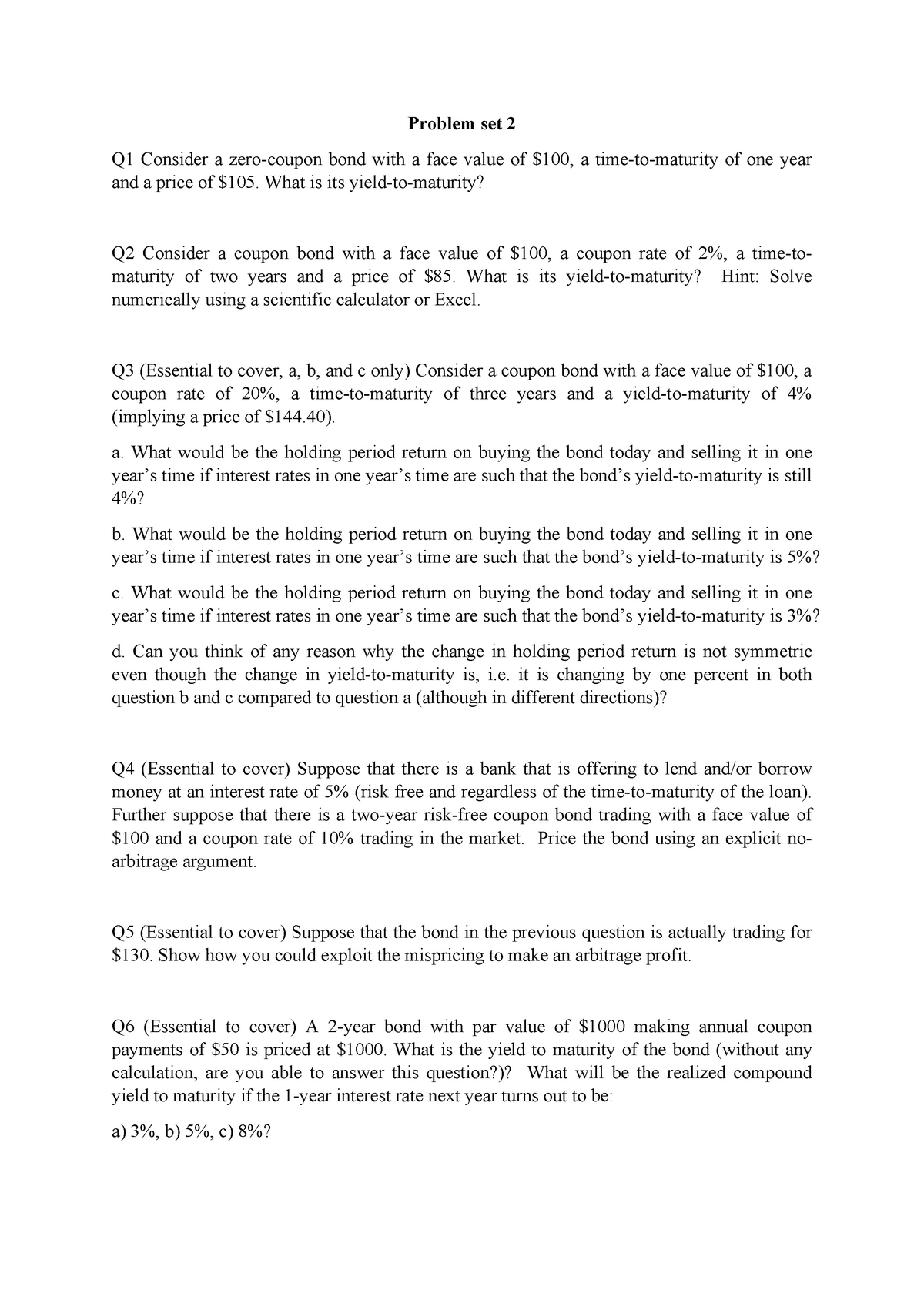

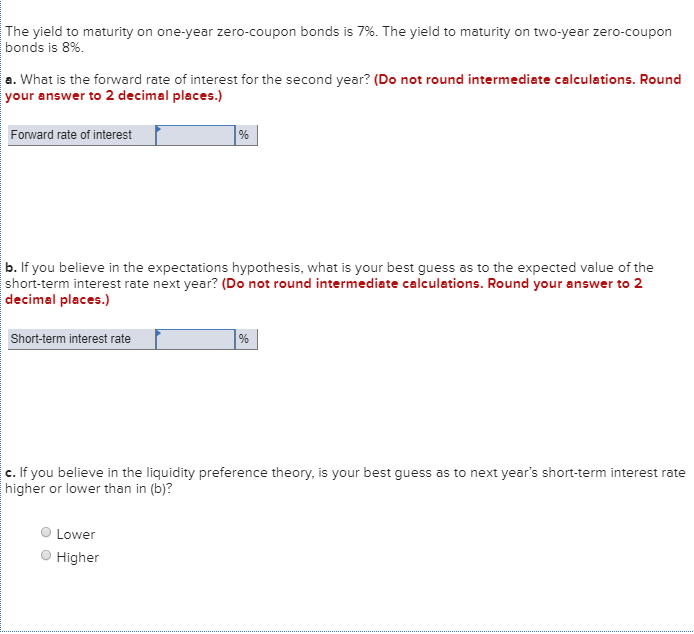

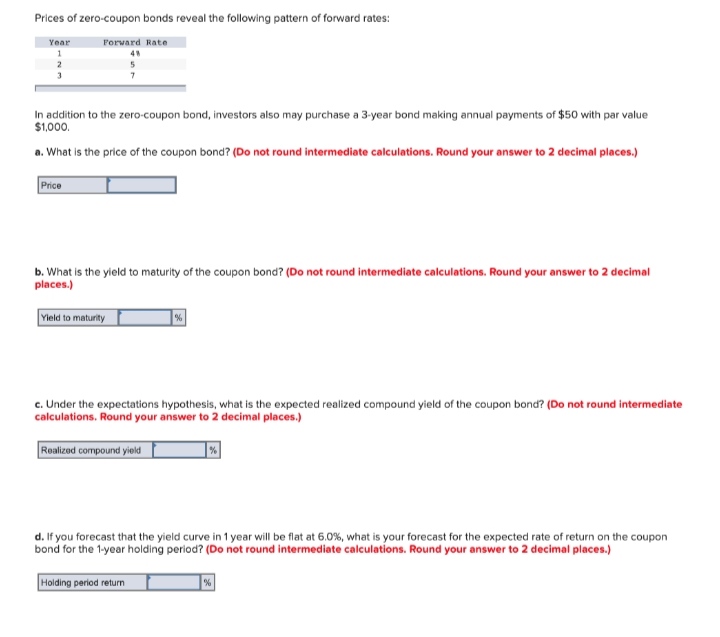

Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always demonstrate yields to maturity equal to their normal rates of return. The yield to maturity for zero-coupon bonds is also known as the spot rate .

Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios.

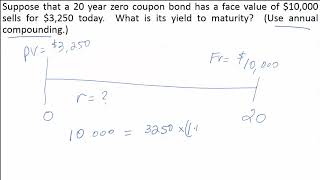

Yield to maturity of a zero coupon bond

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: = ( 1000 925 ) ( 1 2 ) − 1 What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a... Quant Bonds - Yield The yield to maturity is the total return you would get on a bond if it was held to maturity. Yield is the single interest rate which equates the price of a security to the sum of the present values of its cash flows. ... Useless for Zero coupon bonds. Approximation Yield - Yield To Maturity - Takes into account compounding interest, ...

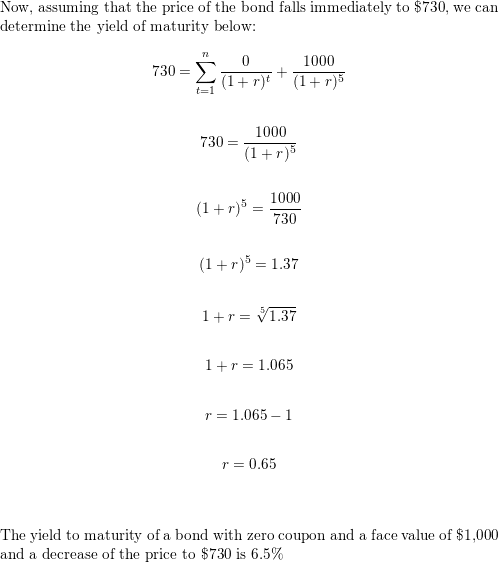

Yield to maturity of a zero coupon bond. Zero Coupon Bond: Calculate the YTM (yield to maturity) - BrainMass 1. Step 1 Look at the value of the bond when it will reach maturity. We have a bond which will be worth $1000 in ten years. 2. Step 2 Check the price that you paid for the bond. We have $459. 3. Step 3 Subtract the number of years between the zero coupon bonds maturity ... Solution Summary If the yield to maturity of a zero-coupon bond with a...get 5 If the yield to maturity of a zero-coupon bond with a $10,000 face value and time to maturity of... O 7974.11. 0746.14. 7531.11. ... 8860.13. This is the question from the valuation of the bond, Here the value of the bond at end of maturity 5years is given $10000 with YTM (Yield to Maturity) = 2.45% ... Germany Government Bonds - Yields Curve Maturity Yield Spread vs Bond Spread vs Central Bank Rate (1.25%) 3 months 1 year 2 years 5 years 10 years; 30 years: 2.106%: 131.0 bp ... The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx ... Yield to Maturity : r/bonds - reddit.com Right now bonds are yielding above their issue interest rate, say a 2 year issued at 3% is now over 4% since the price has fallen to around $97-98. If I buy that bond at $97, I will get the coupon dividends until the time of maturity, plus at maturity I will get back the original $100 for a $3 profit, hence the higher calculated interest rate.

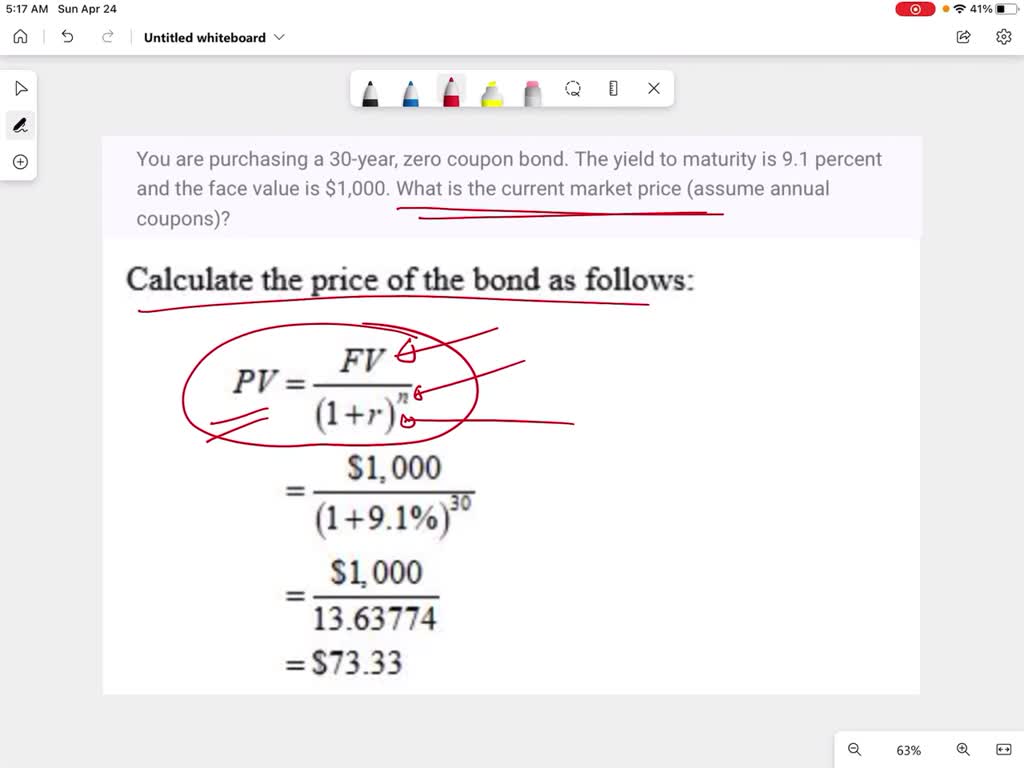

Yield to Call Formula & Examples | How to Calculate Yield to Call ... Example: MDNC issued $1,000 par bonds with a 5.25% annual coupon and five years maturity. The bonds are callable at a strike price of $1,050 with a premium of $60 above par and any accrued interest. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Spot Interest Rate: Meaning, Usage, Calculation, Examples The holders get the face value of the bond at maturity. To measure the rate of return that an investor will require until the maturity period, we calculate the yield for the tenure. In a way, It is actually the present value of the face value of the bond. The spot interest rate is the YTM or yield-to-maturity of such zero-coupon bonds ... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always...

Estimate yield of coupon bond given yield of zero coupon bond The yield on a discount (zero-coupon) bond maturing in 2010 should be higher than that of a coupon bond maturing in 2010 under the stated circumstances. This is because some of the cash flow of the coupon bond will be realized earlier than that of the discount bond, and as shown in the table below, the yield curve, as far as these two bonds are ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Yield to Maturity and Default Risk - Do Financial Blog The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8% coupon rate and pays the $80 coupon once per year. ... Take as an example the 8% coupon bond with a yield to maturity of 10% per year (5% per half year). Its price is $810.71, and therefore its current yield is 80/810.71 = .0987, or 9.87%, which is higher than ...

What Is the Coupon Rate of a Bond? - The Balance Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. ... Coupon Rate vs. Yield . In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a ...

Calculate Price, Yield to Maturity & Imputed Interest for a Zero Coupon ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Calculator - Calculator Academy where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example

How To Invest In Bonds - Forbes Advisor UK To calculate the current yield, divide the annual coupon of £3.75 by the current bond price of £105. This means that the current yield would be 3.57%, which is lower than the 'nominal yield ...

Another milestone: The yield advantage for EE Savings Bonds has ... Right now, 20 year coupon bonds are yielding 4.19% to maturity and their zero coupon cousins are yielding 4.31%; that's a substantial difference. ... Because taxes are normally deferred until maturity on EE bonds, their effective yield to the 20 year doubling is higher than 3.53% — it's more like 3.6% to 3.8%, depending on assumptions ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: = ( 1000 925 ) ( 1 2 ) − 1

Some bonds on secondary market are essentially "Zero-Coupon" bonds I know there are Zero-Coupon government bonds available but I also noticed something else in the secondary bond market. With yields rising, many older bonds are selling at a discount but their coupon can be relatively low (e.g 0.9%). With the discounted purchase price the YTW can be much higher (e.g. 3.8%). But the YTW takes into account the ...

Current Yield vs. Yield to Maturity: What's the Difference? That's why the yield to maturity is only 2.99%. In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

United Kingdom Government Bonds - Yields Curve Maturity Yield Spread vs Bond Spread vs Central Bank Rate (2.25%) 3 months 1 year ... with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; 50 ...

Quant Bonds - Yield The yield to maturity is the total return you would get on a bond if it was held to maturity. Yield is the single interest rate which equates the price of a security to the sum of the present values of its cash flows. ... Useless for Zero coupon bonds. Approximation Yield - Yield To Maturity - Takes into account compounding interest, ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: = ( 1000 925 ) ( 1 2 ) − 1

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 yield to maturity of a zero coupon bond"