38 coupon rate for bonds

What Is the Coupon Rate of a Bond? - The Balance 18/11/2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. Investors are piling into junk bonds. What to know before buying Generally, the wider the spread, the more attractive high-yield bonds become. With high-yield bonds paying 7.29% as of Aug. 10, an investor may receive $72.90 per year on a $1,000 face value bond,...

Coupon Rate Definition - Investopedia 28/05/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon rate for bonds

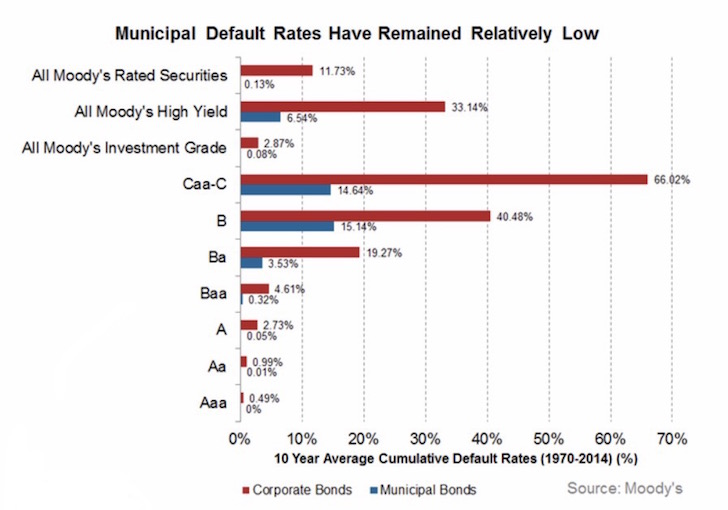

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips The rate you'll pay on bond interest is the same rate you pay on your ordinary income, such as wages or income from self-employment. If, for example, you're in the 37% tax bracket, you'll pay a 37%... What Is Coupon Rate of a Bond - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Coupon Bond | Definition | Rates | Benefits & Risks | How It Works The interest rate that a coupon bond pays is typically higher than the face value, which can confuse some investors who are not familiar with this type of investment vehicle. This high-interest payment is referred to as a "coupon" and represents how much money an investor can expect to receive in interest payments throughout the life of the bond.

Coupon rate for bonds. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo It is quintessential to grasp the concept of the rate because almost all types of bonds pay annual interest to the bondholder, which is known as the coupon rate. Unlike other financial metrics, the coupon payment in terms of the dollar is fixed over the life of the bond. For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the … Coupon Types - Financial Edge The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. The next coupon payment, assuming that LIBOR has been fixed at the aforesaid rate, is computed below (US$970,000). Compare Fixed Rate Bonds | MoneySuperMarket Fixed term bonds generally have minimum and maximum opening deposits. Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... What is the Coupon Rate of a Bond? Coupon Rate is mostly applied to bonds and it is usually the ROI (rate of interest) that is paid on the face value of a bond by the issuers of bond and it is also used to calculate the repayment amount that is made by GIS (guaranteed income security). Coupon rate definition — AccountingTools A high coupon rate can be an indicator that the financial circumstances of an issuer are not the best, forcing it to offer a higher interest rate to investors. Alternatively, a high rate may be required because the market interest rate is also high, and a high coupon rate is needed to attract investors. Example of a Coupon Rate. For example, if the coupon rate is 8%, then the issuer pays $80 of interest per year on a bond that has a $1,000 face value. Coupon Rate Calculator | Bond Coupon 15/07/2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you … 14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. The $17,800 principal balance must be raised …

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2. With semiannual compounding, we see the bond offered at an initially deeper discount than if imputed interest ... Quant Bonds - Variable Coupons - BetterSolutions.com The coupon rate could be variable in cases where the rate of interest is changed periodically in line with maket rates. As the word "Bond" implies a fixed rate of interest, bonds where the coupon rate varies are referred to as "floating rate notes" If issued in London, the coupon may be defined as LIBOR + or - 45 basis points, reviewed every 6 ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... › floating-rate-bondsFloating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

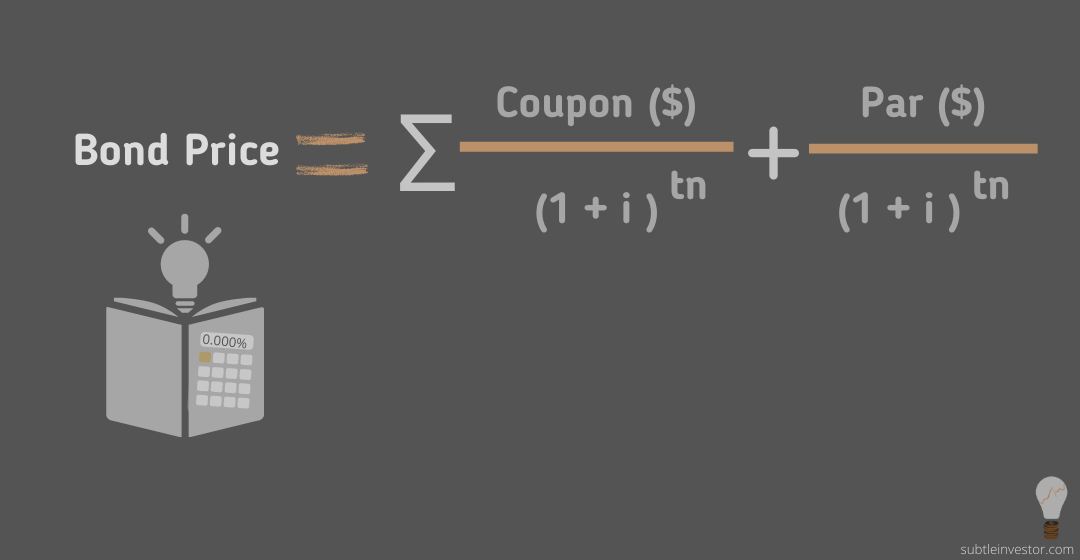

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

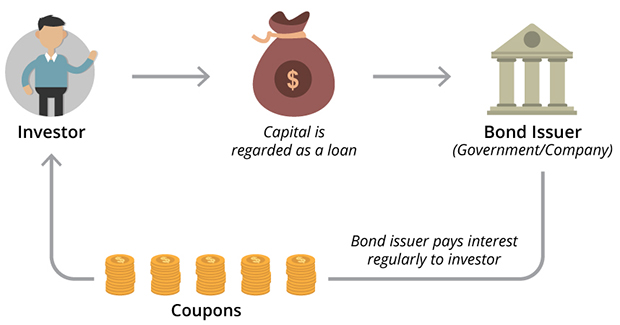

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming ...

Bond Pricing | Valuation | Formula | How to calculate with example | eFM The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing:

Floating Rate Bonds: Characteristics, Rate, and Important Floating rate bonds offer lower Coupon rates than fixed-rate bonds; If issuers put an upper limit on Interest rates through capping, the investors may still face the opportunity costs with higher interest rate bonds availability; Yield-to-Maturity with Floating Rate Bonds: Yield-to-Maturity is the interest rate on bonds or financial instruments over the life of the investment. As floating …

Post a Comment for "38 coupon rate for bonds"