43 yield to maturity coupon bond

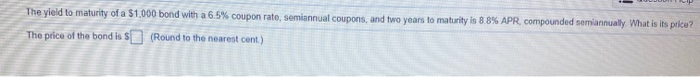

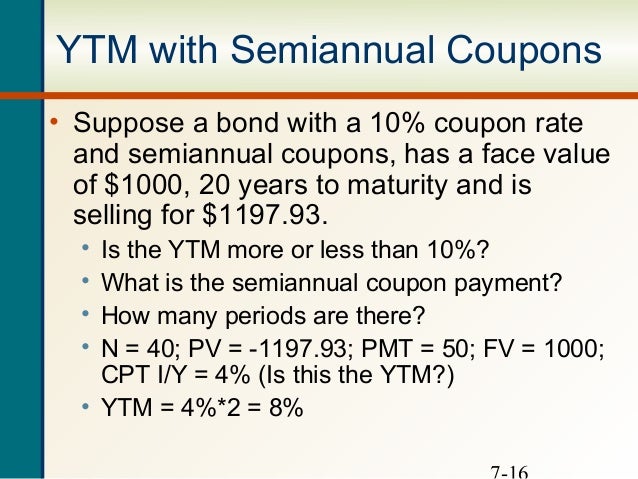

The equivalent annual-pay yield-to-maturity (YTM) for ... The equivalent annual-pay yield-to-maturity (YTM) for a 9.15% coupon quarterly-pay bond is closest to. A. 9.13%. B. 9.28%. C. 9.36%. D. 9.47%. Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - This is an approximate yield on maturity, which shall be 3.33%, which is semiannual.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years.

Yield to maturity coupon bond

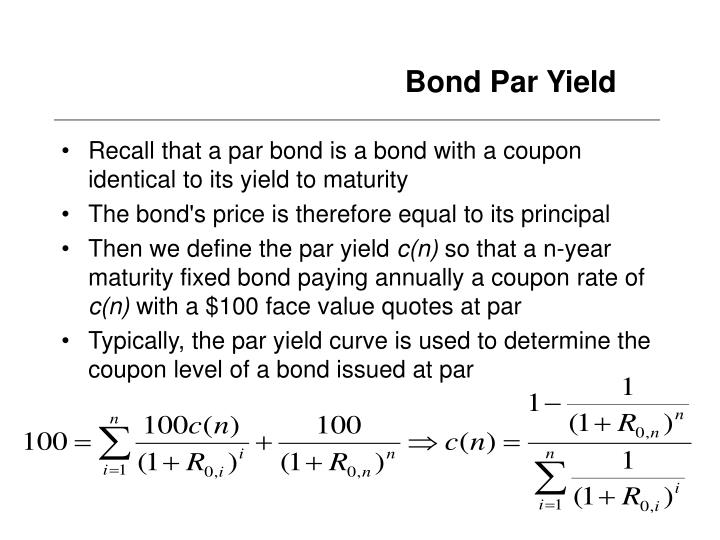

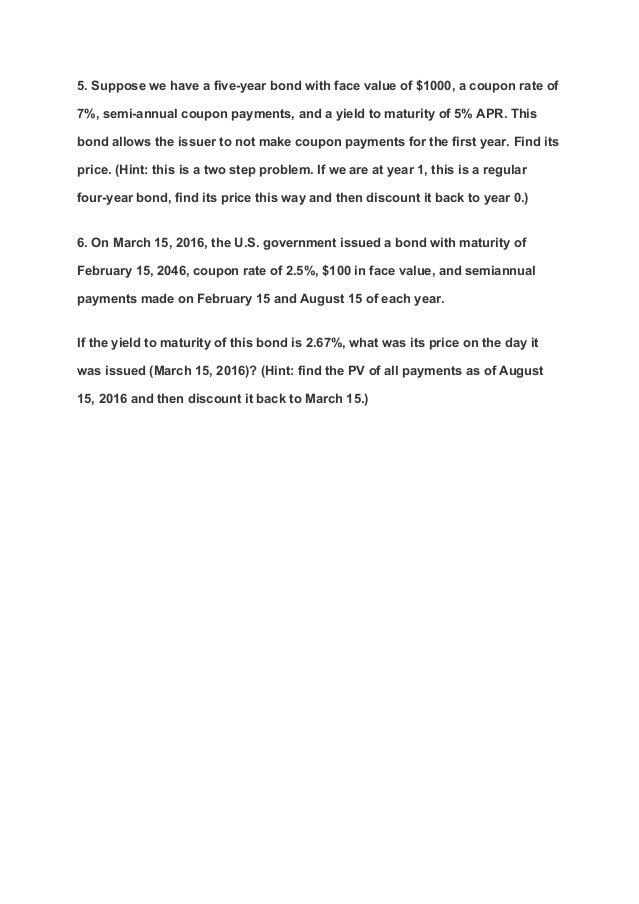

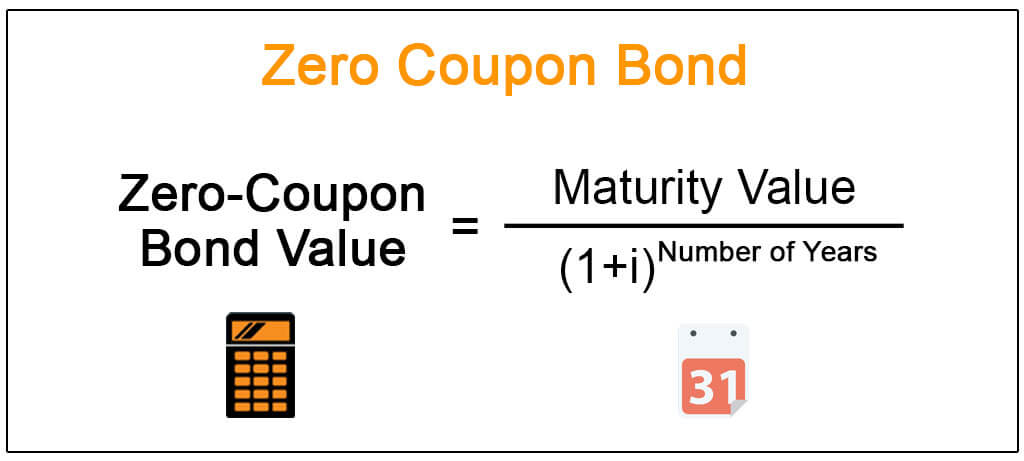

Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel? Yield to Maturity (YTM) - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond... Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to maturity coupon bond. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... Bond Investors Underperformed Despite a Bull Market. Now What? The synthetic STRIP has a zero coupon, a purchase yield equal to the yield of the corresponding point on the coupon STRIP curve, and a purchase price which is derived from the purchase yield. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula shown up top takes into consideration the effect of compounding. For example, suppose that a discount bond has five years until maturity. If the number of years is used for n, then the annual yield is calculated. Considering that multiple years are involved, calculating a rate that takes time value ...

Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%. Bond Yields: Nominal and Current Yield, Yield to Maturity ... Nominal yield, or the coupon rate, is the stated interest rate of the bond. This yield percentage is the percentage of par value —$5,000 for municipal bonds, and $1,000 for most other bonds — that is usually paid semiannually. Thus, a bond with a $1,000 par value that pays 5% interest pays $50 dollars per year in 2 semi-annual payments of $25. Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon RateA coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Yield to Maturity (YTM) Definition & Example ... The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity | Formula, Examples, Conclusion, Calculator The yield to maturity is the rate of return an investor would earn if they held a bond until it reached maturity. This calculation takes into account the face value, the current price, and any coupon payments that are made. What is the yield to maturity formula? The most common formula used to calculate yield to maturity is: YTM = C + F−P/n / F+P/2

Answered: Which one of the following statements… | bartleby THe relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For the bond listed below, state whether the price of the bond will be at a premium to par, at par, or at a discount par. Coupon Interest Rate Yield to Maturity 8% 6%.

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

coupon and yield : bonds Coupon refers to the stated interest rate of the bond. A 5% coupon is $50, etc. Yield refers to the % received buying the bond and can be measured on different end-points (yield to maturity, yield to worst, etc.), and is influenced by the purchase price of the bond (if you buy below par, the yield will be higher than the coupon, if you buy ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The yield to maturity of a bond depends upon the market current price on the bond. However, the yield to maturity formula proves to be a more effective yield of the bond based on compounding against the simple yield which is calculated with the help of the dividend yield formula. Approx YTM = (C + (F-P)/n)*2/ (F+P) C = Coupon / Interest Payment

PDF Yield-to-Maturity and the Reinvestment of Coupon Payments Yield-to-Maturity and the Reinvestment of Coupon Payments Shawn M. Forbes, John J. Hatem, and Chris Paul 1 ABSTRACT This note addresses a common misconception, found in investment texts and popular investment education literature, that in order to earn the yield to maturity on a coupon bond an investor must reinvest the coupon payments.

Understanding Coupon Rate and Yield to Maturity of Bonds ... To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Zero coupon bond yield to maturity calculator 778066-Coupon bond yield to maturity calculator

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to Maturity (YTM) - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond...

Yield to Maturity (YTM): Formula and Excel Calculator From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "43 yield to maturity coupon bond"